Warwick Valley voters approve 2024-25 budget

Voters have approved the Warwick Valley Central School District’s $115,161,458 budget proposal by an unofficial vote of 961 to 361. Additionally, voters approved a bus proposition, and three community members were elected to the WVCSD Board of Education.

The 2024-25 approved budget includes a tax levy increase of 3.49%, which is below the state’s allowable tax cap. This budget marks the ninth time in 12 years that the tax levy increase has remained below the tax cap, which has saved taxpayers a total of $2,910,639. The District has never exceeded the tax cap.

“I would like to thank the community for coming out in support of the 2024-25 budget,” said Superintendent of Schools Dr. David Leach. “The budget manages to tackle prevailing economic concerns while maintaining all current programs and staffing.

“As Board President, I am deeply thankful to our community for their steadfast support. Your trust enables us to uphold our promise of educational excellence,” stated Keith Parsons, President of the WVCSD Board of Education. “Additionally, my heartfelt gratitude and appreciation to my fellow board members and our outstanding district administration. Their attention and hard work led to a budget that is fiscally prudent while delivering top-tier learning experiences for every Warwick student.”

Voters also considered a proposition to purchase five buses for the Transportation Department – two 65-passenger propane buses, two 65-passenger gas buses, one seven-passenger SUV – at a maximum cost of $780,000. The proposition passed by a vote of 923 to 395. The District would use $280,000 of its bus reserve fund to help offset the cost. Of the total cost, $506,220, or 64.9%, would return to the District in state transportation aid. Therefore, no additional taxes would be needed to purchase the buses at a net cost of approximately $500,000.

Three candidates, including one incumbent, ran for three open Board of Education seats:

- Tara Cruz – 978 votes

- William Fanos (incumbent) – 944 votes

- Mandy Blanton – 1,016 votes

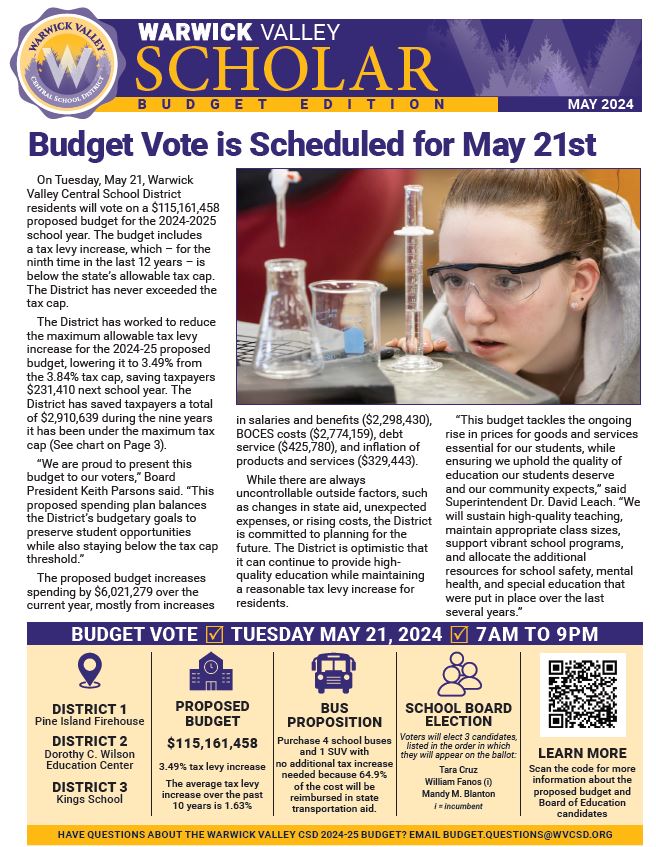

2024-2025 Budget Newsletter

Newsletter |

|

2024-2025 Budget Development

This year’s budget vote takes place on May 21, 2024. Please check this page often for updated information regarding the 2024-2025 proposed budget, as well as local voting information.

Budget Presentations (use the links to view/download presentations)

- February 1:

- February 15:

- March 7:

- March 21:

- April 4:

- April 18:

- May 9:

- May 21: BUDGET VOTE

Board of Education Vote

Three people will be running for WVCSD Board of Education positions. To read the bios of candidates Mandy Blanton, Tara Cruz, and Bill Fanos, click here.

Voting Information

Absentee Ballot ApplicationIf you plan to cast your vote on this year’s budget by absentee ballot, you must request your ballot by using the latest NYS Board of Elections absentee ballot application. This application can be downloaded here to print, fill out and return. The downloadable document includes important eligibility requirements, instructions on returning your ballot, deadlines, and information specifically for military voters. Note: This application may only be used for school district elections by qualified voters who reside in a school district that provides for personal registration of voters. If the application requests the absentee ballot be mailed, the application must be received by the district clerk not later than 7 days before the election for which the absentee ballot is sought. Otherwise, the application may be personally delivered to the district clerk not later than the day before the election. Applications may not be submitted more than 30 days prior to the election. If you are qualified for absentee voting and issued an absentee ballot, the ballot itself must be received by the school district clerk by 5 p.m. on the day of the election in order to be canvassed. |  |

Early Mail Ballot Application |  |

School Tax InformationTax rates for each municipality within the district are set each August. They are based on the tax levy for the year and final municipal assessments for each of the towns. Tax rates vary between towns because property in each is assessed at different levels in relation to full market value. The state assigns each town an equalization rate to fairly divide the tax levy between the towns. The district does not control any part of the assessment or equalization process.

|

Warwick’s Tax Levy History

| Tax Levy Limits, ExplainedThe tax levy limit is the highest allowable tax levy (before exemptions) that a school district can propose as part of its annual budget for which a simple majority of voters (50 percent + 1) would be required for authorization. Any proposed tax levy amount above this limit would require budget approval by a supermajority (60 percent or more) of voters. The tax levy limit sets a threshold requiring districts to obtain a higher level of community support for a proposed tax levy above a certain amount. |