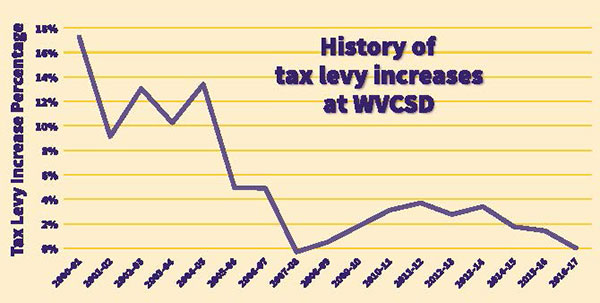

While New York state set Warwick’s tax levy limit at .041% this year, district administrators are proposing a budget for 2016-17 that is under that limit, and will not require any tax levy increase. The proposed tax levy increase for next year is the lowest for Warwick since 2007-08.

The tax levy is the total amount of tax dollars collected by the school district. The tax levy limit is the highest allowable tax levy (before exclusions) that a district can propose as part of its annual budget, while requiring only a simple majority to pass.

“It would have been difficult to enhance programs without some increase in the tax levy if it were not for the non-tax revenue,” said Dr. David Leach. This includes rental income and tuitioning students, which has increased 21.9%—almost $574,000—this year.

“This budget enhances opportunities while having the lowest increase in the tax levy in almost a decade,” Dr. Leach said. “We are fortunate to live in a community that values and consistently supports education, and we don’t take that for granted.”